The Ultimate Guide to the Best Credit Cards for Luxury Hotel Benefits

Disclaimer: This post contains referral links. If you apply for a credit card using our links and are approved, we may receive referral bonus at no extra cost to you. We only recommend products and services that we personally use or believe will add value to our readers. Please consider your financial situation and read the terms and conditions carefully before applying for any credit card.

Why the Right Hotel Credit Card Can Enhance Your Next Hotel Stay

Why do luxury hotel benefits matter for travelers?

Could you imagine booking a standard room hotel, later to find out that you have been upgraded to a preferred room or even a suite? Maybe the hotel decorated the room to your surprise or provided you with special treats upon your arrival from a long flight. Perhaps the hotel informed you that you wouldn’t need to check out from your stay until 2pm or even 4pm. I am sure we would all love these little perks that can come with the benefits of hotel status!

How credit cards can elevate your hotel experience

Credit cards make earning hotel status a whole lot easier than traditional ways of earning status. Let’s be honest, the average person is probably not going to stay upwards of 30 nights per year, every calendar year just to maintain status with a particular hotel rewards program. For the ones who travel a ton or maybe individuals who travel for business, earning status the traditional way is definitely a viable option. For the recreational travelers like us, having the right hotel credit card is a shortcut to hotel status which can earn you some wonderful benefits like I mentioned above!

We want to share each of the major credit card rewards programs (including co-branded hotel credit cards and what each has to offer. We will also talk about certain methods you can additional use outside just earning status to obtain these perks you get during your stay. Finally, we will hopefully be able to give you the necessary information you need to make the right choice for your next upcoming trip!

What to Look for in Credit Cards with Hotel Benefits

Credit card benefits come in all different shapes and sizes as we all know. We will go through each of the different benefits that most of these credit cards include. Keep in mind, different hotel rewards programs will have slight differences in the perks you get with status, but all of them are pretty similar. As with any credit card, consider the annual fee that you will be paying, and make sure that you will be getting more of a benefit than what you will be paying in an annual fee!

Elite status opportunities

One of the first benefits to look for when looking into a hotel credit card is to see what status they will automatically provide you with just by having the credit card open. As a rule of thumb, the higher annual fee you are paying, the more benefits the card will come with, meaning the hotel status they provide you with will be higher. For example, Marriott Bonvoy has several different credit cards. The cards with little to no annual fee will earn you a minimum of Silver status, while their most premium credit card, the Marriott Bonvoy Brilliant will earn you up to Platinum status.

Room upgrades

Depending on the status tier of a hotel program, they will offer you a complimentary room upgrade which is subject to availability. Room upgrades do not necessarily mean getting a suite. However, the hotel will usually do its best to get your preferences of what type of room. This could mean a preferred view, a higher floor, and sometimes an upgraded category of the standard room that was originally booked. If you are very lucky, higher statuses will include possible suite upgrades from standard rooms booked. From what we hear, it is usually rare to be upgraded all the way to a suite from a basic standard room, especially during peak season. However, that is not to say that it is still not possible, and the hotel will usually do its best to keep you satisfied during your stay!

Late checkout privileges

Some of our favorite benefits include not just early check-in at times, but also late checkouts! Imagine being able to stay on a beachfront resort for an additional morning/early afternoon and still having access to your shower before you head home. Maybe you are visiting a city and basically have an extra day before you have to depart home. Late checkout is an awesome benefit to have no matter what the trip is. Although this is subject to availability, the bigger the hotel, the greater chance of them being able to honor late checkout privileges. We have personally never had an issue with late checkout not being available, and at the very least, the hotel will usually have a baggage holding service to be able to hold your bags before your evening flight home or to your next destination!

Complimentary breakfast

Who doesn’t love free food! Complimentary breakfast (or sometimes food & beverage credits) are a wonderful perk that will definitely save you some money during your stay! Many hotel programs will offer this benefit if you have a high enough status. Hilton Honors is one of our favorite hotel programs that we are able to utilize very easily. Even as a solo traveler, we actually recommend reserving for at least 2 guests since the credits are good for up to two travelers! This is not a benefit to miss out on!

Resort credits

Additionally, who doesn’t love free money? Resort credits are great to have as it first offsets the annual fee that you will most likely be paying for the credit card, but it also allows you to enjoy some expenses at a hotel that you maybe wouldn’t have gotten otherwise. Maybe you want to book a session at the hotel spa? Perhaps you want to get some souvenirs at the resort shop. Maybe there is a huge transportation cost that is necessary to get to the resort from the airport or vice versa? These resort credits are very easy to use if you will be staying at the property!

Special amenities

Status programs from each of the hotel loyalty programs will offer a variety of special amenities as well as all of the ones listed above! Examples of this may be welcome gifts upon arrival to the hotel, guaranteed room availability when booking at the very last minute, a dedicated phone line to serve your needs, and more! Here is a list of all of the unique status benefits of popular hotel programs:

Annual free night certificates

Last but not least, co-branded hotel credit cards will usually come with a free night certificate to be redeemed at one of their properties every year. This is a very easy way to offset the annual fee that you will be paying, as the hotel rates will usually be 2 to 3 times higher than what the annual fee would cost. Free night certificates are best used when they are stacked with another reservation to provide an additional night. However, there are plenty of times that we use free night certificates for fun weekend trips that are only hours away from where we live. Unlike airline credit cards, we think hotel credit cards are some of the easiest cards to continue to keep from the annual rewards night benefit alone!

Always review the terms and conditions as well as the limitations and exclusions of using reward night certificates with certain hotel programs. However, most of these free nights will be extremely easy to use!

Premium Hotel Credit Cards

We will go over what we consider to be a “Premium Travel Credit Card” and break down what different types of perks and rewards benefits they have when it comes to staying at hotels!

American Express Platinum Card

The American Express Platinum Card is probably one of the most known travel credit cards in the game! It has a very high annual fee of $695 and so much value to offer if you can use all of the benefits properly. It also has some unique hotel benefits that most travel credit cards do not offer.

Fine Hotels & Resorts program benefits

American Express has a program called Fine Hotels & Resorts (FHR). This is a third-party booking site of American Express that is exclusive to American Express Platinum (or Centurion) cardholders. This is unique as it comes with additional benefits when booking hotels through this portal. Benefits include:

- 12pm check-in (when available)

- Room upgrade upon arrival (when available)

- Daily breakfast for two

- $100 credit towards eligible charges

- Complimentary Wi-Fi

- Guaranteed 4pm check-out

American Express estimates an average total value of $550 when booking a hotel or resort through Fine Hotels & Resorts! This is definitely something to look at if you hold the Amex Platinum and are looking to pay for a hotel stay using cash as you get very valuable benefits like you would of having a high tier status of the hotel program!

The Hotel Collection

Additionally American Express has another program called The Hotel Collection (THC). To be able to book through this third-party booking site, you have to be a card member of the American Express Platinum or the American Express Gold Card. Much like FHR, you will receive unique benefits if booking a hotel through this portal. The only difference is that you do have to stay at least two consecutive nights to receive the THC benefits. These benefits include:

- Room upgrade upon arrival (when available)

- $100 credit to use towards eligible on-property charges during your stay

- 12pm check-in (when available)

- Late check-out (when available) [time not specified on FHR site]

Again, this is something to consider if you hold either the Amex Platinum or Gold card and plan to book a hotel stay at least two nights using cash versus points.

Marriott Bonvoy and Hilton Honors Gold status

Holding the American Express Platinum Card will earn you complimentary Gold status for both Marriott Bonvoy and Hilton Honors programs. This means you will be entitled to all of the Gold status benefits of each of these two programs when staying at one of their properties with the Amex Platinum. Be sure to have your accounts of the hotel loyalty programs enrolled in your Amex Platinum so that it can recognize the complimentary status.

Chase Sapphire Reserve

The Chase Sapphire Reserve is another popular travel credit card that is highly utilized in the points and miles community. Back when it first came out in 2016, it was so popular that Chase actually ran out of metal to produce the card! Even today with the slightly elevated annual fee of $550, it is still one of the most valuable credit cards to use for free hotel and resort stays!

The Edit (previously the Luxury Hotel & Resort Collection)

Much like the American Express FHR and THC programs, Chase also has a program called “The Edit” program (previously known as the Luxury Hotel & Resort Collection) You do have to hold the Chase Sapphire Reserve in order to book a stay through this portal. Booking stays through here can also offer benefits similar to that of the American Express FHR and THC programs! Here is a list of these benefits:

- Daily breakfast for 2

- $100 property credit (on-property charges)

- Room upgrade at check-in (when available)

- Early check-in (when available) [time not specified on The Edit site]

- Late check-out (when available) [time not specified on The Edit site]

- Complimentary Wi-Fi

You should definitely take advantage of these perks if you plan to book a stay using cash and hold the Chase Sapphire Reserve. It also pairs well with the annual $300 travel credit that comes with being a cardholder! Additionally you will be earning 3 points per dollar spent.

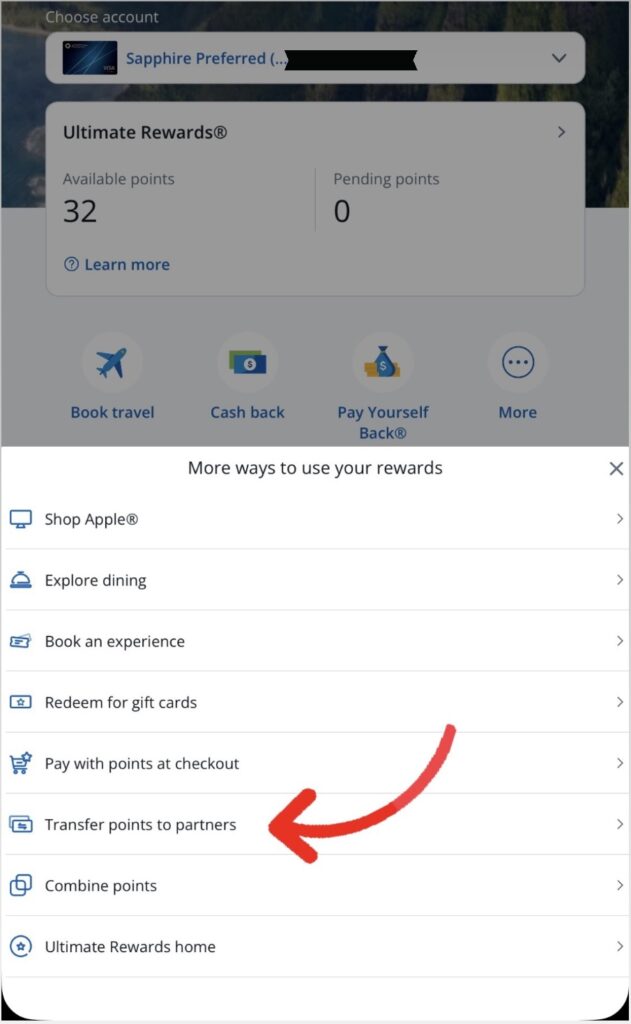

Transfer options to hotel partners

The most utilized benefit that we use is to transfer your Chase UR points to its hotel partners. The most valuable hotel transfer partner to use is the World of Hyatt program hands down. Using this option alone is not only a simple method to use, but it can make such a difference in the value you get with using Chase UR points due to the high valuation of World of Hyatt points (1.8 – 2.2 cents per point) compared to other hotel loyalty programs!

Marriott Bonvoy Brilliant American Express Card

If you are a fan of the Marriott Bonvoy program, one of the best credit cards to hold is the American Express Marriott Bonvoy Brilliant Card! This is Marriott Bonvoy’s highest tier co-branded credit card, and it comes with a hefty $650 annual fee! That being said, the benefits that come with being a cardholder are unbeatable when it comes to staying at Marriott Bonvoy properties!

Elite status benefits

Holding this card will earn the member complimentary Platinum Elite status with the Marriott Bonvoy program. This is only two tiers down from the highest status tier with the program. High status can earn you much of the wanted benefits (room upgrades, early check-in, late check-out, welcome amenities, etc.) when staying at a hotel or resort!

Free night award

Of course, being a cardholder of a co-branded credit card means that you will earn an annual free night award with each month of your card renewal! The free night award is capped at 85,000 points but can also be topped off with additional Marriott Bonvoy points up to 15,000, making it possible to redeem a 100,000 point stay.

$100 Marriott Bonvoy Property Credit

If you book direct using a special rate (2 night minimum stay), you will receive up to a $100 property credit for qualifying charges at The Ritz-Carlton or St. Regis!

Hilton Honors Aspire Card

Probably our favorite co-branded credit card to hold would be the Hilton Honors Aspire! This was considered one of the most “overpowered” co-branded hotel credit cards and still is in our opinion! The benefits and credits that you earn by holding this card can score you some really nice experiences and perks when staying at Hilton properties!

Diamond status benefits

Everyone’s favorite benefit from this card is, without a doubt, the automatic Diamond status that you get from being a cardholder. Diamond status is the highest tier you can earn when staying at Hilton properties! This benefit becomes extremely useful outside the U.S. where this credit card is unavailable to apply for in outside countries. As you can imagine, Diamond status benefits are some of the most valuable during your stays with Hilton. The food & beverage credit alone can provide tremendous savings!

Resort credits

Holding the Aspire card will include a resort credit of $200 to be used semi annually when staying at a Hilton resort! This credit is very easy to use and allows for offsetting of the annual fee quite easily. The resort credit can be used for about anything including dining, spa treatments, activities, and transportation just to name a few things!

Free night reward certificate

The other major benefit of the Aspire is that it comes with a free night reward certificate upon first opening the card and then every renewal after! Hilton probably has the best value when it comes to free night reward certificates because there is no cap on the rewards night (aside from the list of exclusions), and you earn the free rewards night shortly after becoming a card member, unlike the other co-branded hotel cards which make you wait until your card renewal date! Be sure to use the credit for one of Hilton’s top tier properties to earn the most value!

Co-Branded Hotel Credit Cards Worth Considering

World of Hyatt Credit Card

World of Hyatt has one (personal) co-branded credit card that comes with a $95 annual fee. It is quite a valuable card given that it gives the cardholder complimentary Discoverist status. Even though this is not one of the higher status tiers in the World of Hyatt program, Discoverist status can land you room upgrades, early check-in, and late check-out as well as possible other accommodation from the property! Additionally the card will award the member a free night certificate (up to Category 4) on every renewal date of the card! This immediately gives you a positive ROI for holding the card as by only paying $95 for the annual fee, you can easily redeem a hotel that may easily cost up to $200 to $300 or even greater! Also, one of the wonderful things about redeeming rewards nights is that the taxes and resort fees are waived, saving you even more money!

IHG One Rewards Credit Cards

IHG One Rewards has two co-branded (personal) credit cards. The first one (IHG One Rewards Traveler Credit Card) is a no annual fee credit card that offers automatic Silver Elite status in the IHG One Rewards program. The second one (IHG One Rewards Premier Credit Card) has an annual fee of $99 and offers the cardholder automatic Platinum Elite status. Both cards have the benefit of getting the fourth night free when booking three nights with points. The IHG One Rewards Premier card also has some additional benefits including a free night reward certificate (up to 40,000 points, having the ability to top on more points for a higher redemption) as well as one of the only “mid-tier” co-branded hotel credit cards to offer a Global Entry, TSA PreCheck, or NEXUS credit (up to $120) every four years of holding the card. These benefits immediately offset and provide a positive ROI for its only $99 annual fee!

Ritz-Carlton Credit Card

Lastly, one of the hidden gems in Chase credit cards would be the Ritz-Carlton Credit Card of the Marriott Bonvoy loyalty program. There is actually no way to apply for this card directly from Chase. Instead, you have to hold either the Marriott Bonvoy Bold or Marriott Bonvoy Boundless (both personal cards issued by JPMorgan Chase Bank), and after the first year of holding the card, you have to contact the bank to ask for a product change to the Ritz-Carlton Credit Card. We would say that this is another powerful co-branded hotel credit card that is worth mentioning. The card offers the user complimentary Gold Elite status, a free night reward certificate that is valued up to 85,000 points (with the ability to top on an additional 15,000 points for a total of an 100,000 points redemption), and it comes with $300 travel credit that can be used for airline incidentals! All of these benefits make its $450 annual fee extremely easy to get a positive ROI!

Maximizing Your Hotel Credit Card Benefits

Stacking benefits strategies

To maximize your benefits and hotel stays, it is always a great idea to plan any potential hotel stays you want to use with a particular hotel loyalty program, sign up for their credit cards to earn the sign-up bonus and get the automatic status, then potentially use any free night rewards earned on your booked stay with points. You also want to be sure you take advantage of point redemption offers related to Marriott Bonvoy and Hilton Honors fifth night free benefit (when booking 4 nights with points only) and IHG One Rewards fourth night free benefit (when booking 3 nights with points only). Using these strategies can save you a ton of money, especially combined with the food/beverage and resort credits that most of these co-branded hotel credit cards come with!

When to use points vs. paid stays?

A good rule of thumb to redeem a stay for points is to make sure you are getting at least the standard value of the particular hotel points. Here is a chart of the estimated cent-per-point value of the major hotel loyalty programs:

|

Marriott Bonvoy |

0.7 – 0.9 cent-per-point |

|

Hilton Honors |

0.5 – 0.6 cent-per-point |

|

World of Hyatt |

1.8 – 2.2 cent-per-point |

|

IHG One Rewards |

0.6 – 0.7 cent-per-point |

Use the following formula to calculate the cent-per-point value before you redeem a free night stay:

Cash price of redemption / Number of points required = Cent-per-point

If you are not earning at least the standard value of your hotel points, then we would recommend using cash to book versus redeeming with points.

Booking through the right channels

Depending on whether you are booking with cash or points, you may want to look into FHR or THC if you are an American Express Platinum or Gold cardholder or The Edit program if you are a Chase Sapphire Reserve holder. Using these could land you some additional benefits versus if you were to book directly with the hotel! If you are booking using points, of course you would want to book directly with the hotel. This means if you have a travel credit card, you would want to transfer your points directly to its hotel partners for the most value!

Comparing Annual Fees vs. Benefits

Cost-benefit analysis of premium cards

With the high annual fees that come with some of these credit cards, you will have to compare the benefits that you will earn if you continue to hold the card. It can be very easy to get more value than what you are paying for the annual fee due to the reward night certificates that come with most co-branded hotel credit cards. However, you have to ask yourself if you plan to stay at these hotel properties if you weren’t rewarded the free night certificates. If the answer is no and you feel that you don’t travel very much,, you may want to reconsider getting a co-branded hotel credit card.

Break-even calculations

To determine your break-even point, you need to take the annual fee of the credit card, then add up all of the benefits you feel that you can use from holding the card. This includes the cash value for reward night certificates, any resort credits you think you can use by holding the card, and any other additional benefits and value that come with having hotel status. This may include getting upgraded to a room that may have cost $50 to $100 or more, additionally than what you paid to book originally. We can safely say that if you are using the reward night certificate benefit and you were already planning to stay at the property, co-branded credit cards are a no-brainer to maximize your benefits during your stays!

How to determine if a card is worth it for your travel style?

Depending on your travel habits, the right credit card is an important aspect to maximize the value you get without overstepping your boundaries. If you are not a frequent traveler or don’t plan to stay at a five star resort, it wouldn’t really make sense to get the Marriott Bonvoy Brilliant or Hilton Honors Aspire. However, if you fit this category, these two high-tier cards could very much benefit you and bring much more value than the annual fees that it would cost to hold these cards! If you are a more casual traveler looking for a mid-tier hotel, perhaps the World of Hyatt or IHG One Rewards Premier card may suit your needs better with the free annual night and a much less annual fee to pay to hold the card.

How to Choose the Right Card for Your Luxury Hotel Needs?

Questions to ask yourself

Before you decide to go with a co-branded credit card, or any travel credit card for that matter, you will definitely want to ask yourself if you already plan to stay at these hotel brands in the future to make sense of holding the card with the annual fees that they hold. We never recommend going out of your way to stay at one of these hotels or resorts just to redeem the benefits if you weren’t going to do so in the first place. Be sure that you will always be hitting your break-even point, preferably even more. Also, consider your budget when traveling as you will most likely still have to pay for incidental costs that come with taking a vacation. Lastly, always remember to pay off your credit card balances in full to prevent paying any interest or late fees, as this will negate any rewards or benefits that you could possibly earn from being a cardholder.

Evaluating your travel patterns

Think of your future travel plans to see if it would make sense to have a higher-tier credit card. If you think you would benefit your stay greatly, then it would probably make sense to have it. Keep in mind that you can always product-change a credit card down to a no annual fee card if your travel habits change. This is the beauty of credit card rewards, as you are never stuck with just one card’s benefits as you can try different programs, and you always have the flexibility to downgrade or upgrade depending on your travel habits for the year!

Considering hotel brand loyalty

Another thing to consider are the actual properties of the hotel programs. Maybe you are a fan of one hotel program over the other. Maybe you want to get the most value out of your credit card points. Also, you will want to keep in mind the footprint that these hotel programs have. Marriott Bonvoy and Hilton Honors have the largest footprints, following IHG One Rewards, and finally World of Hyatt which has the smallest footprint of the 4 hotel loyalty programs.

Conclusion

Summary of top picks for different traveler types

As a catch-all travel credit card to transfer points, you have options such as:

- American Express Platinum

- American Express Gold

- Chase Sapphire Reserve or Preferred

- Capital One Venture X

Your higher-tier co-branded hotel credit cards include:

Mid-tier co-branded hotel credit cards include:

Finally, the low-tier co-branded hotel credit cards include:

Final recommendations

As you can see, you have a list of high-tier to low-tier credit card possibilities that you can apply for when it comes to co-branded hotel credit cards. Low-tier credit cards will not come with a free annual night but have the first level of hotel status and the ability to earn points to get started. Mid-tier cards have the ability to earn an annual free night award for the more frequent traveler. Finally high-tier cards will have the maximal benefits of earning valuable perks when staying at top-tier properties for the big travelers. Of course, the “catch-all” travel credit cards are always recommended for any type of traveler because their points can spread out anywhere, making it very flexible to reap the benefits for any user!

Our final recommendation is to start low-tier or mid-tier and work your way up to higher-tier co-branded hotel credit cards to see if they make sense for you. We have had some incredible stays with both mid-tier and high-tier co-branded credit cards, specifically in the World of Hyatt program and the Hilton Honors program! Always take account of your travel patterns and finances, and always make sure you will be getting more benefit than what you would be paying for an annual fee!

![Best Hotel Loyalty Programs for Free Luxury Stays: Ultimate Guide [2025]](https://danielleandharry.com/wp-content/uploads/2025/03/IMG_3136-768x576.jpg)